M&A Predictions: Photonics & Optics

By 2025, the market for photonics-enabled systems should grow to almost $2 trillion. Leading photonics players have developed high-powered lasers with artificial intelligence (AI)-based vision systems.

The global Industrial Laser Systems market is forecasted to generate $29.3 billion in revenue by 2028 through a compound annual growth rate (CAGR) of 7.7% from 2022 to 2028, according to ReportLinker.

Demand for photonics and laser technologies has grown beyond traditional, industrial applications and is now often utilised in the Aerospace & Defence, Microelectronics, Medical, Consumer Packaged Goods, and Automative sectors.

Automative Sectors

The push towards industry 4.0 and automation is boosting the demand for laser systems. Advanced laser systems are highly reliable and precise making them integral to automated production lines.

Aerospace & Defence

Aerospace and defence sectors can utilise photonics and laser technologies precision in the following systems and operations: Directed Energy Weapons, Anti-UAV Systems, Free-Space Optical Communication, Inter-Satellite Links, Laser Rangefinders, Laser Designators, LIDAR (Light Detection and Ranging), Additive Manufacturing, Surface Treatment, Laser-Based Sensors, Optical Surveillance, Inertial Navigation Systems (INS), Precision Landing Systems and Satellite Technology.

Microelectronics

Businesses in the microelectronics industry are making use of photonics and laser technologies to significantly advance manufacturing and performance of the following applications: Photonic Integrated Circuits (PICs), Laser Lithography, Optical Interconnects (Chip-to-Chip Communication and Reduced Latency), Laser Processing, Optical Metrology, Defect Detection, Optoelectronic Devices, Thermal Management, Quantum Computing, Laser Patterning, Additive Manufacturing and 3D Integration.

Medical

Laser technology and photonics are now more frequently used in the medical sector this includes: Laser Surgery, Photocoagulation, Optical Coherence Tomography (OCT), Fluorescence Microscopy, LASIK (Laser-Assisted In Situ Keratomileusis), Photodynamic Therapy (PDT), Laser Ablation, Laser Dentistry, Skin Resurfacing, Laser-Induced Interstitial Thermo-therapy (LITT), Non-Invasive Monitoring, Endoscopic Laser Treatment, and Photo-thermal Therapy.

Consumer Packaged Goods

Laser technologies and photonics have several impactful applications in the CPG industry including: Laser Marking and Engraving, Laser Cutting, Optical Inspection Systems, Spectroscopy, Laser-Based Automation, Robotic Vision Systems, Laser Prototyping, Laser Cleaning, Serialisation, Supply Chain Visibility, Personalised and Interactive Packaging, Authentication and Anti-Counterfeiting, and Food Safety Monitoring.

Looking back at M&A in Photonics and Optics before looking forward

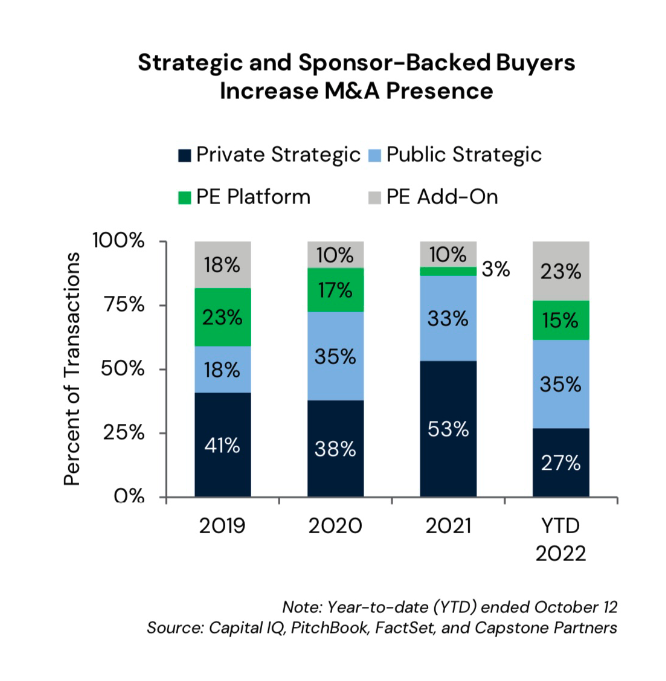

The above graph taken from pitchbook, makes for some interesting observations.

Why did private strategic M&A decline by almost half between 2021 and 2022?

One cause for the decline in private strategic mergers and acquisitions between 2021 and 2022 could be attributed to the COVID-19 pandemic and its lingering effects to supply chains and leaving investors more cautious. M&A across all industries softened in 2022 due to the pandemic. However, in this case specifically, we think this is unlikely to be the only reason.

Looking at the above graph there seems to be an emerging trend of fluctuation followed by slight decline in photonics and optics private strategic mergers and acquisitions year on year. By removing the COVID-19 anomaly from the pattern, we would expect 2023’s to have increased to around 50% and we might predict 2024’s to decrease to around 45%.

Capstone Partners report ‘Product & Technology Diversification Spurs Elevated Merger and Acquisition Activity’ published in January 2023 stated,

“While limited disclosed M&A multiples create difficulty in determining average pricing trends, recent notable transactions have showcased public buyers’ wiliness to pay premium valuations for sector participants with advanced technologies serving key end markets. This includes Hamamatsu Photonics’ (TSE:6965) acquisition of NKT Photonics in June 2022 ($216.2 million, 2.6x EV/Revenue), Jenoptik’s (XTRA:JEN) acquisition of BG Medical/SwissOptic in November 2021 ($349.1 million), and Lumentum’s (Nasdaq:LITE) acquisition of NeoPhontonics in November 2021 ($871.5 million, 3.1x EV/Revenue).”

2024 Mergers & Acquisitions in the Photonics & Optics Industry

In 2024, there have been several notable mergers and acquisitions that illustrate the photonics and optics growth potential.

- Keysight Technologies acquired Spirent Communications for approximately $1.463 billion, outbidding Viavi Solutions to secure the acquisition, which is expected to boost its capabilities in network performance testing.

- Coherent Corp acquired II-VI Incorporated in a deal valued at approximately $7 billion. The aim of this merger is to enhance Coherent’s position in the photonics market by expanding its product portfolio.

- IPG Photonics completed the acquisition of Laser Quantum (which began in 2017). This deal was worth approximately $40 billion. Following the acquisition, IPG is expecting to expand its technology offerings and market research, particularly in the scientific and industrial laser sectors.

Conclusion

If we take a look at the most significant mergers and acquisitions in 2023 and the most significant in 2024 so far, side by side, we can see that the transactions have increased from millions of dollars to billions in the past year.

If you found this useful and would like to see more content like this, please tag us on LinkedIn letting us know what you’d like to see: AdaptTalent

f you’re in the AI or Semiconductor market looking for a new and exciting business to join we partner with some of the best in the industry, alternatively if you are a business looking to expand your team, contact us to get a scope on the current market.